The good news is that individuals who suffer from obesity and desire to become healthier have options. One of these options is bariatric surgery, which most insurance covers in most cases. There are also some newer procedures available to help them lose weight that do not require surgery. The question now arises: Is ESG (Endoscopic Sleeve Gastroplasty) covered by insurance?

The bad news is that many patients find the financial obligations related to getting the help they need daunting. They need to know answers to questions like whether Endoscopic Sleeve Gastroplasty is covered by insurance or if their insurance will cover a gastric bypass. Today we are going to look at the relationship between obesity and insurance and how to navigate your way through it.

Does Insurance Cover Weight Loss Surgery?

Insurance carriers cover some types of weight loss surgery, but each company has different requirements and limitations. Even if a patient has a body mass index (BMI) that classifies them as morbidly higher in weight, their insurance may not necessarily approve bariatric surgery. Not every carrier automatically covers bariatric surgery for every person with a high BMI number. Individuals considered candidates for bariatric surgery:

- Have tried losing weight through diet and exercise but have been unsuccessful:

- Have a body mass index of 40+.

- Have a body mass index of at least 35+ and are suffering from obesity-related health issues such as type 2 diabetes, and high blood pressure.

- These are just the basics of the criteria for determining eligibility for weight loss surgery and individuals will need to check with their insurance companies for specifics.

Why All Insurance Companies Should Cover Bariatric Surgery

Currently, 23 states mandate the inclusion of bariatric surgery in ACA-compliant health plans. However, the list currently does not include Georgia or Florida (this list does not include group insurance or private health plans). Weight loss surgery, as well as non-surgical weight loss procedures, should be covered on insurance plans for many reasons including:

1. Bariatric Surgery Improves Overall Health

The benefits of bariatric surgery have been the subject of much research and have been published through many different outlets. Many patients experience total remission of type 2 diabetes after losing weight as a result of bariatric surgery. Moreover, weight-related illnesses and risks that are reduced after weight loss surgery are:

- Heart Disease and Stroke.

- High Blood Pressure.

- Sleep Apnea.

- Cholesterol Issues.

- Asthma and Breathing Issues.

- Arthritis and Joint Problems.

- GERD (Gastroesophageal Reflux Disease).

- Fatty Liver Disease.

- Some Cancers.

- Urinary Incontinence and Bladder Issues.

2. Reduction in HealthCare Spend

A significant reduction in the amount of money spent on healthcare would occur if the United States reduced the instances of obesity.

Annually, healthcare costs directly associated with treating adults afflicted by obesity-related illnesses amount to an estimated $147 billion to over $210 billion. Furthermore, this figure represents approximately 22% of the total medical expenditure in the United States. Moreover, childhood obesity-related illnesses contribute to healthcare spending of more than $14 billion every year.

In addition, a 2018 report by the Milken Institute detailed and categorized the costs of chronic diseases related to the obesity epidemic to the tune of $480.7 billion in direct costs, and $1.24 trillion indirectly from lost productivity. The report went on to state that obesity accounted for over 47%, and was the largest contributor, to the costs related to chronic diseases in the United States.

Bariatric Surgery and Insurance Coverage

There is a fine line between what insurance companies consider necessary for one’s health and elective or cosmetic procedures. They are also notoriously slow to recognize and embrace medical and technological advancements that bring new procedures despite their effectiveness or lower costs.

At this time, most insurance companies that allow for bariatric surgery will cover gastric bypass surgery, gastric sleeve surgery, and lap-band surgery. Patients need to do their research and find the carriers that cover bariatric surgery and the specifics related to the coverage. Research should include the following steps:

- Review the fine details of coverage in the health insurance policy.

- Vet and choose a qualified in-network surgeon:

- Find out if you are a qualified candidate.

- Work with the surgeon to confirm eligibility and coverage with the insurance company

Getting Your Health Insurance To Pay For Weight Loss Surgery

Just because your health insurance policy reflects they cover certain types of bariatric surgery, doesn’t mean it will be easy for you to utilize it.

Be Prepared

Usually obtaining a pre-approval from the insurance company requires a good amount of paperwork. Each company has its requirements as well as the definition of ‘medically necessary” when considering a patient a qualified candidate.

Overall, most insurance companies require documented proof of medically supervised weight-loss attempts and do not consider programs like Weight Watchers or others as adequate.

Collaborating with an experienced bariatric surgeon will not only help you navigate through this process but also ensure a better experience. Moreover, most bariatric specialists firmly believe that advocating for their patients is an integral part of their responsibility as surgeons. Rest assured, they will work diligently and tirelessly to assist you every step of the way.

It is important to have a good understanding of what your insurance policy covers and expects so you can successfully receive approval.

Be Persistent

According to the American Society of Metabolic and Bariatric Surgery, one of the top reasons that patients do not have bariatric surgery is because they are denied coverage.

Apparently, for about 25% of the patients trying to utilize their coverage, it is an uphill struggle and they are denied 3 times before approval.

If your policy states it covers the type of surgery that you are after and you meet the qualifications as a patient, do not give up. You may have to jump through some hoops and go through an appeals process but with the help of your surgeon, you should eventually get approval.

Should ESG be covered by insurance?

Currently, insurance plans do not cover endoscopic sleeve gastroplasty (ESG), but they should! ESG has gained notoriety over the past several years. The procedure is just as effective as gastric sleeve surgery with fewer complications because there are no incisions. In July 2022 ESG became FDA-approved. It is likely that in the future it will be covered by insurance plans. Learn more in the official press release.

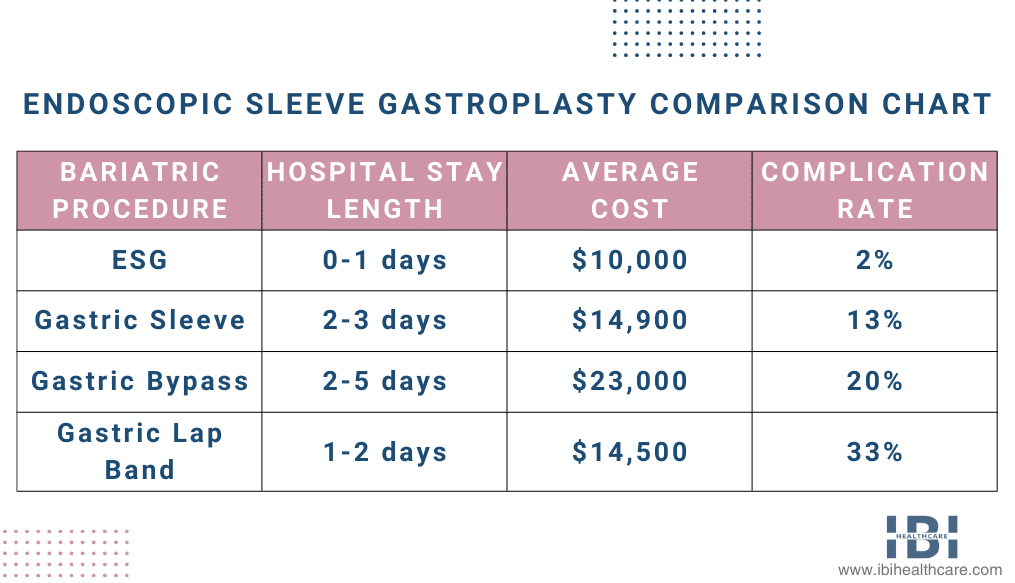

Complications from surgery translate into increased medical costs to address the complications. Gastric sleeve surgery has an associated complication rate of 13% which is far higher than the 2% related to endoscopic sleeve gastroplasty (ESG).

Firstly, insurance companies can significantly lower healthcare expenses by including coverage for non-surgical weight loss solutions, such as ESG. Secondly, this applies to the difference in costs between endoscopic sleeve gastroplasty and regularly covered bariatric surgeries. Additionally, patients achieving weight loss and improving their health can result in overall cost reductions for obesity-related ailments.

Insurance will hopefully cover non-surgical weight loss for patients in the future.

What Do I Do if My Insurance Does Not Cover Bariatric Surgery?

You have options if you want to have a procedure like ESG that health insurance currently does not cover.

Also, most bariatric surgeons work with companies that offer medical loans to help patients finance necessary surgery. IBI Healthcare offers flexible financing options, and some of them require no payments in the first 3-6 months. It may also be possible to offset costs using an FSA or HSA account.

Additional alternatives may include:

- Changing employers or insurance carriers that offer coverage for bariatric surgery.

- Begin a medical weight loss program with a bariatric surgery center.

- The IRS allows certain deductions for weight loss-related costs that you may be eligible to benefit from.

Additionally, if you are interested in bariatric weight loss or the ESG procedure, please contact IBI Healthcare Institute today. Moreover, find out if insurance covers your surgery. Finally, during your consultation, our staff can answer your questions about various weight loss options to meet your goals.