Bariatric Insurance Precertification Requirements

Learn about the bariatric insurance precertification requirements, including requirements, documentation, and steps to get approval. Some health insurance programs cover bariatric surgery, but not all do. Furthermore, determining if your plan offers coverage and the type of coverage can be challenging. One insurance provider usually offers multiple plans. With each one offering coverage for different procedures or different levels of coverage by the procedure.

Bariatric Surgery Coverage

The best way to determine the bariatric insurance precertification requirements and exact coverage. Offered on your insurance plan is to speak to someone from the insurance company. Additionally, each insurance carrier provides a list of requirements that you must meet. Before they will even consider approving bariatric surgery.

As part of the recent healthcare reform, several states have passed laws. That requires health insurance companies to include bariatric surgery benefits. Particularly for patients who meet the criteria as described by the National Institute of Health (NIH).

How can I find Medical Insurance that covers Bariatric Surgery?

If you anticipate that Bariatric Surgery is in your future. Then you should compare the available insurance policies carefully. To determine which one would best suit your needs. Pay close attention to detail because within one insurance company. Similarly, they may offer several different plans. Even if you have coverage on your current plan, details can change from year to year.

Sometimes, consulting with a bariatric surgeon will help. Particularly, determining the current insurance coverage. Additionally, they can suggest a better policy to choose during open enrollment.

Bariatric Surgery Source Online has an Information Guide for research purposes. Especially for those looking for insurance coverage for bariatric surgery.

Make sure you complete your due diligence. Ensuring having a correct and accurate information before selecting a plan.

Bariatric Surgery Coverage - Requirements and Qualifications

Yes, there are bariatric insurance precertification requirements. Patients must meet before they qualify for bariatric surgery. There are basic requirements that are universal and then requirements imposed by each insurance carrier that vary by company. According to bariatric insurance precertification requirements, individuals must have a doctor’s diagnosis stating:

- A BMI of 40+.

- Currently, weigh at least 100 pounds more than your ideal weight.

- A BMI of 35+ and suffer from a weight-related illness. Such as Type 2 Diabetes, Hypertension (High Blood Pressure), and Severe Sleep Apnea. As well as any other potentially life-threatening medical or obesity-related condition.

Insurance Carriers Prerequisites

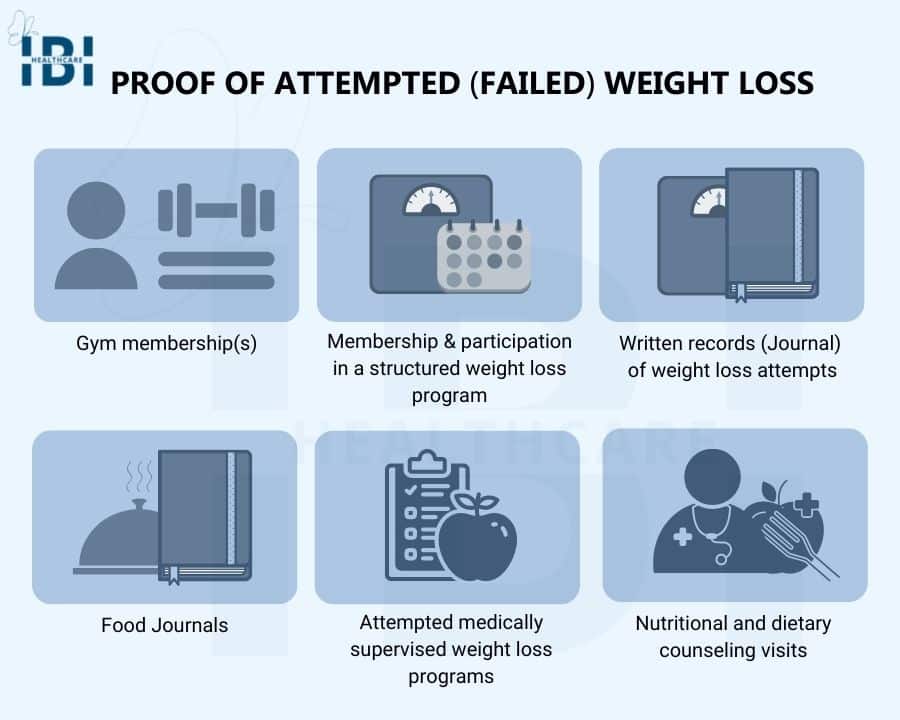

In addition to the bariatric insurance precertification requirements listed above. Insurance companies also each have their list of prerequisites. The patient must have documented proof that they have tried other methods to lose weight but have been unsuccessful. Most companies require that the patients have tried a program that lasted at least six months. Some forms of acceptable documentation of attempted weight loss may include:

- Food journals.

- Gym membership(s).

- Written records (Journal) of weight loss attempts.

- Nutritional and dietary counseling visits.

- Attempted medically supervised weight loss programs.

- Proof of membership and participation with a structured weight loss program such as Jenny Craig or Weight Watchers.

Many insurance companies also require patients to complete psychological testing. Further ensuring that they understand the results and long-term requirements of the procedure. In addition, clearing them of any disorder that may prevent them from being able to make the lifestyle changes necessary.

What Can I do to Avoid Being Denied Coverage for Bariatric Surgery?

Many insurance companies cover surgical weight loss procedures. However, their pre-authorization and approval process not only complicated but also lengthy. Providing all the information required in the correct format can help avoid an extended appeal process after a denial.

If you ensure that you meet all of the insurance carrier’s pre-qualification criteria. Above all can provide clear documentation. You are less likely to run into a denial issue. Here are some steps you can take to help avoid being denied authorization for bariatric surgery.

1. Review Your Current Policy to Determine Coverage

- Every insurance company must provide a “certificate of coverage”. Precisely detailing the health benefits you and your dependents have coverage for under the plan. Include the details of the covered services, as well as any uncovered exclusions.

- If you determine you do have coverage, identify the prerequisites they require. So you can ensure you meet them before applying for pre-authorization.

- If your current policy does not offer the coverage you need. Then you will either need to plan to change carriers or financially prepare to self-pay for your surgery.

2. Assemble and Communicate with Your Medical Team

- Start with your primary care physician and communicate your desire to have bariatric surgery to them. Some insurance companies require a referral from your primary to begin the process of choosing a bariatric surgeon.

- Your primary doctor may also be able to help you with documentation. Specifically on previous weight loss attempts if you were under their supervision. If you still need to complete these prerequisites. Then your primary physician can assist you with the process.

- Many times there are medical tests the bariatric doctor will want you to undergo. Before having weight loss surgery you will need to work with your primary care doctor on getting these completed.

- Next, choose a board-certified bariatric surgeon who accepts your health insurance and set up a consultation. During your consultation, you and the bariatric surgeon will exchange medical information. As well as determine which weight loss surgery will be best for you.

- The bariatric surgeon will be instrumental in helping you navigate through the pre-approval process before your surgery. Every bariatric surgeon’s office has a person who handles their insurance. As a valuable resource in gaining approval for your procedure.

- The bariatric surgeon’s office has years of experience navigating through the approval process of various insurance companies. Ensuring that the insurance company receives complete and accurate information. The pre-approval process can help avoid a lengthy appeal process.

3. Compile and Organize Documents

- Compile and organize your medical records, and any history of unsuccessful attempts at losing weight. Likewise, take any other pertinent information to your consultation with your bariatric surgeon.

- If you are just beginning to complete the prerequisites to qualify for surgery. Be sure that you document every appointment, visit, or anything having to do with losing weight. For example a visit to a dietitian, or a supervised weight-loss program.

- Such as Weight Watchers, and dates with times at the gym. We advise you to keep a journal with as much detail as possible including any receipts for services.

- The bariatric surgeon will help you with the submission of the required medical documentation necessary during the pre-approval process. Further demonstrating the medical necessity of bariatric surgery.

4. Submit Your Bariatric Insurance Coverage Request

- After meeting with the bariatric surgeon you will more than likely have some tasks to complete. Moreover finish fulfilling the insurance company’s prerequisites.

- Once everything is in order the bariatric surgeon’s office will help you submit the request.

What Part Does My Bariatric Surgeon’s Office Play in Obtaining Authorization for Surgery?

The bariatric surgeon will confirm the benefits of your specific policy. All requirements you must meet under your policy guidelines. During your initial consultation, we will discuss these requirements and prerequisites in detail. If at any time during your treatment, the details of your insurance coverage change. Please contact the surgeon’s office as soon as possible.

Once you fulfill all the prerequisites for both the surgeon and the insurance company. You can proceed with the next steps. The surgeon’s office will submit all the required documentation to the insurance company for review.

Furthermore, it can take weeks to months to receive a reply. Once the bariatric surgeon receives a reply they will move on to the next step. If the insurance company approves your surgery.

The medical staff will set up a surgery date and a preoperative appointment. Finally allowing the process to begin. If the insurance company denies pre-authorization. Then the bariatric surgeon’s office will review the details with you and prepare to proceed with the appeal process.

Why Does the Insurance Approval Process Take So Long?

Typically, it takes about two or three days for the bariatric surgeon’s office to submit all the documentation. Necessary to the insurance carrier which starts the approval process. The insurance company will review all of the paperwork and send a letter of acceptance or denial. It can take anywhere from 15 days to several months to get a reply from the insurance company.

Our office will follow up on the submission for approval regularly until we receive an answer. If the process lags, we may contact you and have you call and follow up as well.

Denied Coverage, What Can I Do to Appeal the Decision?

If the insurance company denies your initial request for pre-authorization for bariatric surgery. You can appeal the decision. Every insurance carrier has a process you can follow to file a formal appeal. You can address each specific reason cited for the denial.

Sending a clearly stated reply letter with as much detail and backup as possible is the best course of action. However, some carriers limit the number of appeals you can make. Therefore, it is important to find out the appeal guidelines of your plan.

The process of appealing a denial can be lengthy. But your chances of overturning a previous denial are greater. If you include as much information as possible in your letter of reply and keep the content professional. Your bariatric surgeon’s office can help you compose the letter because they have experience with advocating for patients.

Appeal letters should contain:

- Your Identification including your name, insurance policy, claim, and group numbers.

- A summary of the reason(s) for denial using the wording from the denial letter you received.

- State the reason you are appealing. Clearly explain why their denial is incorrect and provide additional facts. Keep your reasons for wanting the surgery focused on health.

- Clear up any errors, if your denial was due to an omission of the necessary information. You can also correct incorrect coding by providing additional information.

- You may need to include additional health history depending on denial reasons.

Make a file and keep copies of all information you send to the insurance company. Take notes with dates, times, and names of any individuals you speak to over the phone at your insurance company. Persistently advocating for your appeal can help overturn the denial decision.

What are My Options if I Do Not Have Insurance that Covers the Procedure?

If your insurance plan does not cover weight loss surgery. Moreover, does not provide adequate coverage for the procedure you are going to undergo. You may wish to change insurance providers during open enrollment. Speak to your bariatric office’s insurance specialist. Ask about recommendations for carriers who provide sufficient coverage for the procedure you desire.

Begin to familiarize yourself with the prerequisites required for bariatric surgery and begin working to fulfill them. Keep records of everything so you can submit all of the backup documentation required. If you are unable to obtain health insurance that covers bariatric surgery. You can speak to your surgeon about any financing options they may offer.

For self-pay patients consider a lower-cost non-surgical weight-loss procedure. For instance, Orbera® Gastric Balloon©, Endoscopic Sleeve Gastroplasty (ESG), or Laparoscopic Sleeve Gastrectomy (LSG). Nonetheless, our medical team will assist you throughout the process. Meanwhile, you can also explore how our financing options, including the CareCredit. Provide coverage for traditional medical insurance copayments and elective procedures.